Joint work with Santiago Pereda Fernández. Under review at Econometric Reviews (third round).

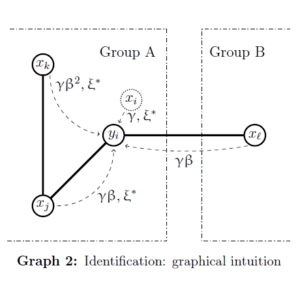

Abstract. Conventional methods for the estimation of peer, social or network effects are invalid if individual unobservables and covariates correlate across observations. In this paper we characterize the identification conditions for consistently estimating all the parameters of a spatially autoregressive or linear-in-means model when the structure of social or peer effects is exogenous, but the observed and unobserved characteristics of agents are cross-correlated over some given metric space. We show that identification is possible if the network of social interactions is non-overlapping up to enough degrees of separation, and the spatial matrix that characterizes the co-dependence of individual unobservables and covariates is known up to a multiplicative constant. We propose a GMM approach for the estimation of the model’s parameters, and we evaluate its performance through Monte Carlo simulations. Finally, we show that in a typical empirical application about classmates our approach might estimate statistically non-significant peer effects when conventional approaches register them as significant

Abstract. Conventional methods for the estimation of peer, social or network effects are invalid if individual unobservables and covariates correlate across observations. In this paper we characterize the identification conditions for consistently estimating all the parameters of a spatially autoregressive or linear-in-means model when the structure of social or peer effects is exogenous, but the observed and unobserved characteristics of agents are cross-correlated over some given metric space. We show that identification is possible if the network of social interactions is non-overlapping up to enough degrees of separation, and the spatial matrix that characterizes the co-dependence of individual unobservables and covariates is known up to a multiplicative constant. We propose a GMM approach for the estimation of the model’s parameters, and we evaluate its performance through Monte Carlo simulations. Finally, we show that in a typical empirical application about classmates our approach might estimate statistically non-significant peer effects when conventional approaches register them as significant

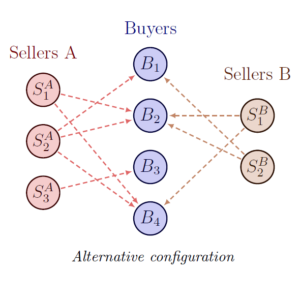

Abstract. This paper develops a framework for the empirical analysis of the determinants of input supplier choice on the extensive margin using firm-to-firm transaction data. Building on a theoretical model of production network formation, we characterize the assumptions that enable a transformation of the multinomial logit likelihood function from which the seller fixed effects, which encode the seller marginal costs, vanish. This transformation conditions, for each subnetwork restricted to one supplier industry, on the out-degree of sellers (a sufficient statistic for the seller fixed effect) and the in-degree of buyers (which is pinned down by technology and by “make-or-buy” decisions). This approach delivers a consistent estimator for the effect of dyadic explanatory variables, which in our model are interpreted as matching frictions, on the supplier choice probability. The estimator is easy to implement and in Monte Carlo simulations it outperforms alternatives based on group fixed effects. In an empirical application about the effect of a major Costa Rican infrastructural project on firm-to-firm connections, our approach yields estimates typically much smaller in magnitude than those from naive multinomial logit.

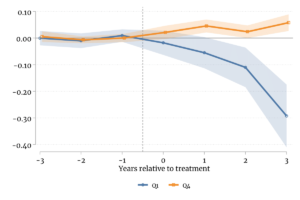

Abstract. This paper develops a framework for the empirical analysis of the determinants of input supplier choice on the extensive margin using firm-to-firm transaction data. Building on a theoretical model of production network formation, we characterize the assumptions that enable a transformation of the multinomial logit likelihood function from which the seller fixed effects, which encode the seller marginal costs, vanish. This transformation conditions, for each subnetwork restricted to one supplier industry, on the out-degree of sellers (a sufficient statistic for the seller fixed effect) and the in-degree of buyers (which is pinned down by technology and by “make-or-buy” decisions). This approach delivers a consistent estimator for the effect of dyadic explanatory variables, which in our model are interpreted as matching frictions, on the supplier choice probability. The estimator is easy to implement and in Monte Carlo simulations it outperforms alternatives based on group fixed effects. In an empirical application about the effect of a major Costa Rican infrastructural project on firm-to-firm connections, our approach yields estimates typically much smaller in magnitude than those from naive multinomial logit. Abstract. We explore the effect of a reduction in overall labor costs, indirectly induced by an Italian reform that weakened employment protection legislation, on the productivity distribution of manufacturing firms. Due to the unique institutional features of the Italian collective bargaining system, in the manufacturing sector the reform led to a clean reduction in average worker compensation, without altering the average structure of employment relationships. This decrease in labor cost resulted in a reduction in average total factor productivity (TFP) among less productive firms, and an increase at the upper end of the distribution. We pair these findings with increased entry and exit dynamics among low-productivity firms, suggesting the presence of an adverse selection mechanism at the bottom of the TFP distribution, enhanced by the reform. We formalize this concept via a general equilibrium model that links productivity to frictions in the markets for inputs.

Abstract. We explore the effect of a reduction in overall labor costs, indirectly induced by an Italian reform that weakened employment protection legislation, on the productivity distribution of manufacturing firms. Due to the unique institutional features of the Italian collective bargaining system, in the manufacturing sector the reform led to a clean reduction in average worker compensation, without altering the average structure of employment relationships. This decrease in labor cost resulted in a reduction in average total factor productivity (TFP) among less productive firms, and an increase at the upper end of the distribution. We pair these findings with increased entry and exit dynamics among low-productivity firms, suggesting the presence of an adverse selection mechanism at the bottom of the TFP distribution, enhanced by the reform. We formalize this concept via a general equilibrium model that links productivity to frictions in the markets for inputs.